student loan debt relief tax credit application for maryland resident

State Comptroller Peter Franchot says these persons can apply for the. The deadline for the states Student Loan Debt Relief Tax Credit Program for Tax Year 2022 is Sept.

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Otherwise recipients may have to repay the credit.

. Ad Md Student Loan Tax Credit. More than 40000 Marylanders have benefited from the tax credit since it. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

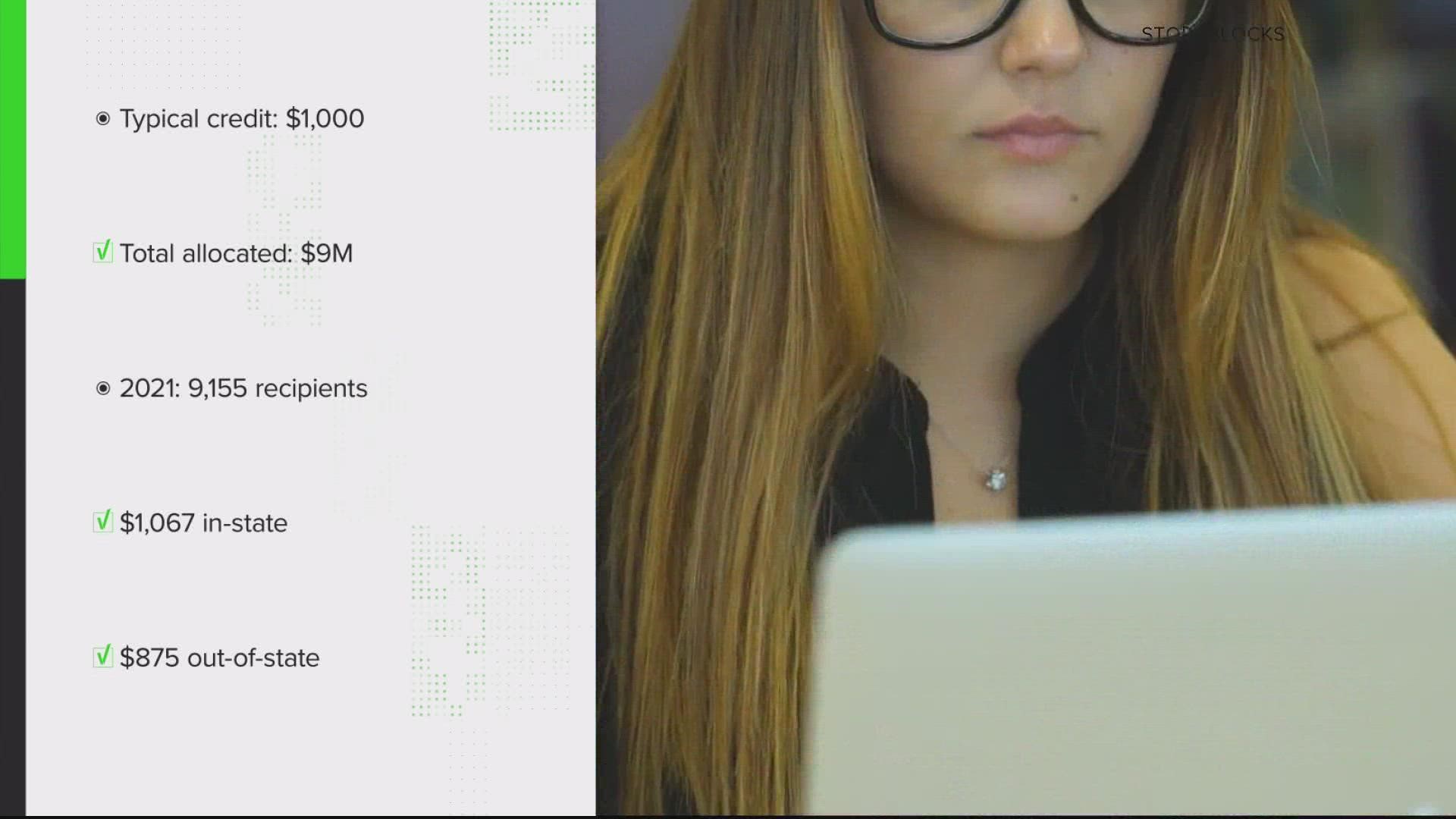

Annapolis Md KM Maryland residents who are burdened by student loan debt can get some relief. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. 15 to apply for a Student Loan Debt Relief Tax.

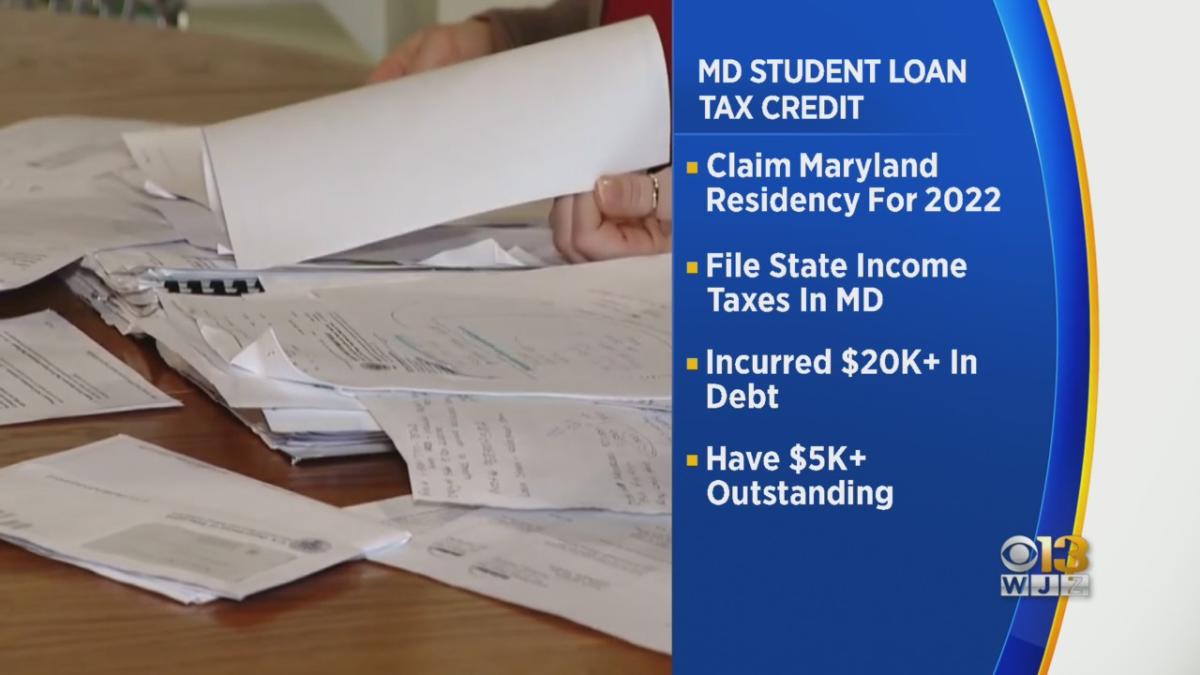

The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents. For Maryland Residents or Part-year Residents Tax Year 2020 Only. Browse Our Collection and Pick the Best Offers.

Check Out the Latest Info. More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

Eligible Individuals have until Sept. Student Loan Debt Relief Tax Credit Application. Going to college may seem out of reach.

Maryland residents looking to claim student loan debt relief must do so in less than two weeks. Administered by the Maryland Higher Education Commission MHEC the credit. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Md student loan tax credit. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code.

To qualify you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. Complete the Student Loan Debt Relief Tax Credit application. Instructions are at the end of this application.

More than 40000 residents have received the tax credit since the. Marylands student loan debt relief tax credit has been providing relief to residents for years now. Going to college may seem out of reach for many Marylanders given the.

Credit for the repayment of eligible student loans. Eligible people have until Sept. The deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming in less than three weeks.

Ad Apply For Tax Forgiveness and get help through the process. Who wish to claim the Student Loan Debt Relief Tax Credit. Ad You Would Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program.

With more than 40 million distributed through the program.

Biden Announces 10 000 In Student Loan Debt Relief The New York Times

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit 24 7 Wall St

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

More Student Loan Relief Here S How Marylander Taxpayers Can Apply Wusa9 Com

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

Student Loan Forgiveness May Come With A State Income Tax Bomb

What Is Maryland Student Loan Debt Relief Tax Credit Statanalytica

Tax Credit 2022 Deadline For Maryland Residents To Claim 1 000 Student Loan Debt Relief Credit Is 18 Days Away U S World Gazette Com

As President Biden Prepares To Extend Loan Repayment Pause Governors Address Root Causes Of The Student Debt Crisis

Biden Announcement On Student Loan Debt Expected Soon

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 More Than 40 000 Students Graduates Have Received Credit Since 2017 The Baltimore Times Online Newspaper Baltimore News

Marylanders Encouraged To Apply For Student Loan Tax Credit

Student Loan Forgiveness Means Higher Taxes In North Carolina And Possibly 4 Other States Cnet

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wjla

Comptroller Of Maryland Facebook

Tax Credit 2022 Deadline For Marylanders To Claim 1 000 Student Debt Relief In 13 Days Washington Examiner